The Interim Report of Auto Fuel Market Monitoring For 2021 I Quarter

Considering the high public interest Georgian National Competition Agency publishes an interim report for the 2021 I quarter as part of its active fuel market monitoring.

The first quarter of 2021 was marked by the trend of the increasing price of crude oil and, consequently, the price of platts. The price of the platts reached a maximum on March 12 - 546 USD, from $ 420 on January 4, 2021, and as of March 31, it amounted to 497 USD. During the same period, the national currency depreciated by 4.1% against the US dollar by 13.5 points, which was reflected in the cost of imported fuel and, consequently, in the retail selling prices of auto fuel in the country.

In the 1st quarter of 2021, 315 884 thousand liters of petrol and diesel were imported by 23 economic agents in the country, which is 2% more than the same figure for the 1st quarter of 2020 - 309 487 liters.

Import Market Concentration - The HHI index has been defined by 1348 units, which is an indicator of a moderately concentrated market.

The share of the 5 largest importing economic agents in the total import is 74.3%, while the share of the other 18 importing companies is within 25.7%.

The largest volume of fuel was imported from the Russian Federation - 23.9%, followed by Turkmenistan - 21% and Romania - 20.2%.

44% of total imports were identified as diesel fuel and 56% petrol.

From petrol-type fuels, the most in-demand was Regular fuel, with a percentage of 65.4% in petrol and 36.6% in total imports.

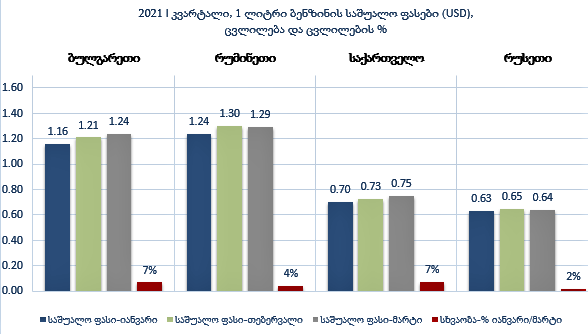

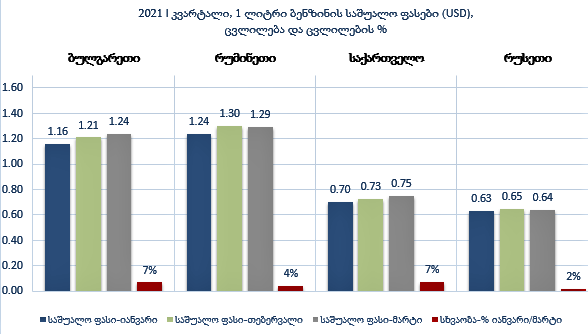

Dynamics of retail price change - in the fuel supply countries, in the first quarter of 2021, as well as in Georgia, retail sales prices were characterized by the price-increasing trend.

According to 2020, the total share of the five major economic agents operating in the retail market is 56.5%, while the total share of other companies is within 43.5%. The increased number of petrol stations is mainly due to the entry of new economic agents in the market and, in general, the activation of the small network segment, which, in turn, was reflected in the overall share distribution of the retail market sales level. For comparison, the total share of the mentioned segment in 2018 was 39.6%, in 2019 - 39.9%, and 2020 - 43.5%. The price range and difference were differentiated on the same brand of fuel, allowing the customer to make a variety of choices. Since 2013, the number of operating economic agents in the import, as well as wholesale and retail sales of petrol and diesel has increased, the market concentration index has decreased, which is an indicator of the improvement of the competitive environment.

At the beginning of 2015, about 960 petrol stations were operating in the retail market, in 2019 - 1210, and in 2020 their number was 1216.

In 2020, at the relevant market retail level, the market concentration index - Herfindahl Hirschman Index (HHI) was 746 units, which is a low concentrated market rate. (HHI is more than 2250 - Highly concentrated market, HHI is less than 1250 - Low concentrated market).

According to the Georgian National Competition Agency, competition in the market is active and price changes are caused by market and foreign factors. Current processes in the Georgian market in terms of price changes were practically identical to the current processes in the local markets of fuel suppliers in the region.

In addition to the general assessment of the competitive environment in the market, the Georgian National Competition Agency, within the framework of monitoring the auto fuel market, regularly monitors the retail selling prices of auto fuel and presents it to the public periodically.